Romney's CRUT Tax Dodge

Mitt Romney reduced his tax bill using a loophole called the Charitable Remainder Unitrust (CRUT), Jesse Drucker of Bloomberg revealed last week. Congress cracked down on the CRUT in 1997, but those who had already created these structures were allowed to keep using them. Romney set his up in 1996 and used the shady trust to defer taxes for over 15 years:

“The main benefit from a charitable remainder trust is the renting from your favorite charity of its exemption from taxation,” Blattmachr said. Despite the name, giving a gift or getting a charitable deduction “is just a throwaway,” he said. “I used to structure them so the value dedicated to charity was as close to zero as possible without being zero.”

When individuals fund a charitable remainder unitrust, or “CRUT,” they defer capital gains taxes on any profit from the sale of the assets, and receive a small upfront charitable deduction and a stream of yearly cash payments. Like an individual retirement account, the trust allows money to grow tax deferred, while like an annuity it also pays Romney a steady income. After the funder’s death, the trust’s remaining assets go to a designated charity.

As Drucker explains, the tax-free payouts from the trust account for only a small percentage of Romney’s $250 million net worth.

The Mormon Church benefits little from this arrangement. As money from the trust has been paid out to the Romneys, the amount available for donation upon their deaths has already declined from $750,000 in 2001 to $421,203 at the end of 2011. Usually, there isn’t much left over by the time the trust holder spends his last tax-sheltered buck.

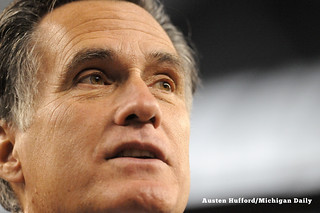

[Photo credit: Austen Hufford, Creative Commons.]